Best Virtual Credit Cards for Online Payments

With the rise of online shopping and digital payments, virtual credit cards (VCCs) have become a necessity. They offer enhanced security and flexibility for various services, making them an ideal choice over traditional credit cards. In this blog, we’ll explore the best virtual credit card options and their benefits.

What is a Virtual Credit Card (VCC)?

A virtual credit card is a digital payment tool that functions like a traditional credit card but does not have a physical form. It is primarily used for online transactions and provides security against fraud.

Top Virtual Credit Card Providers

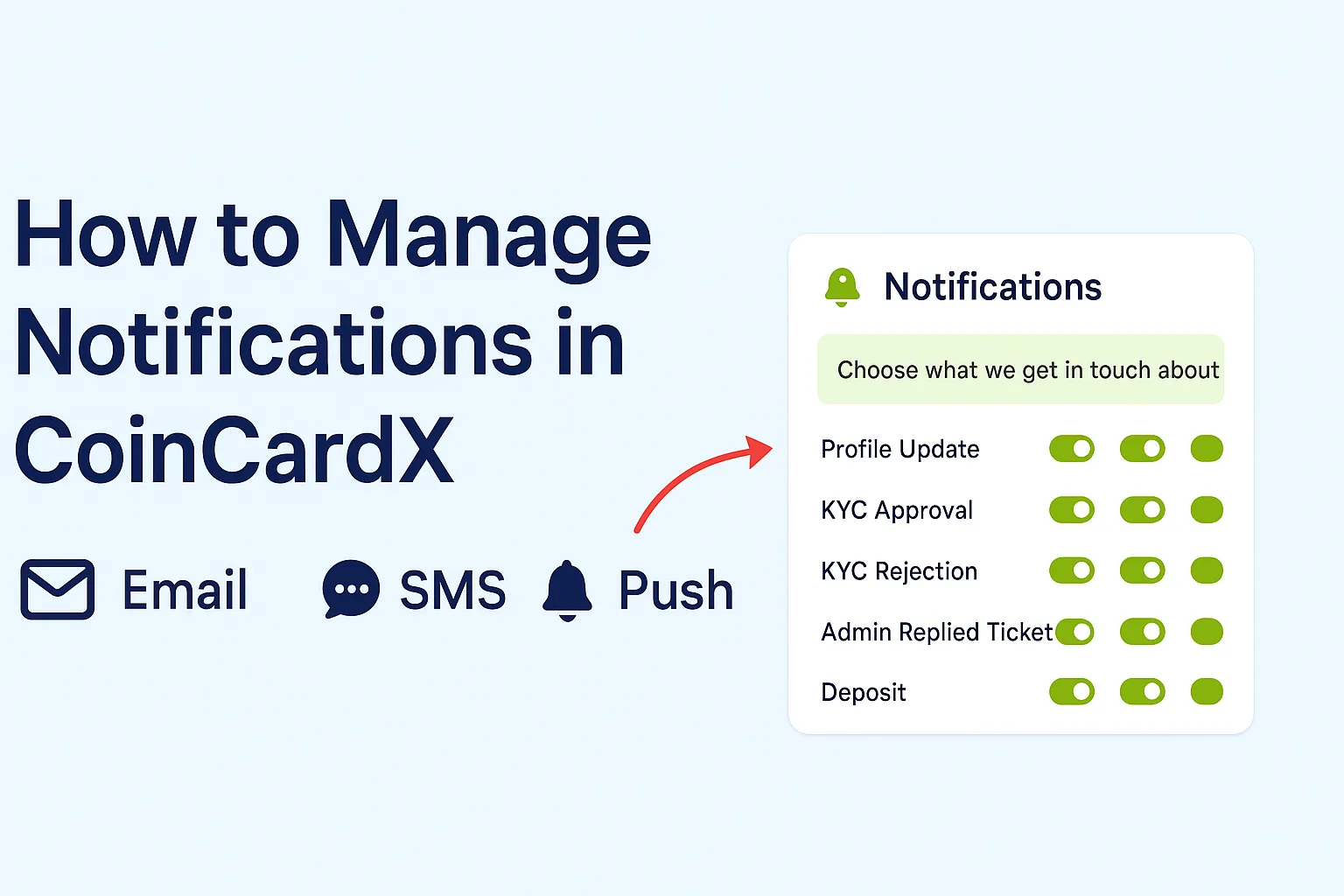

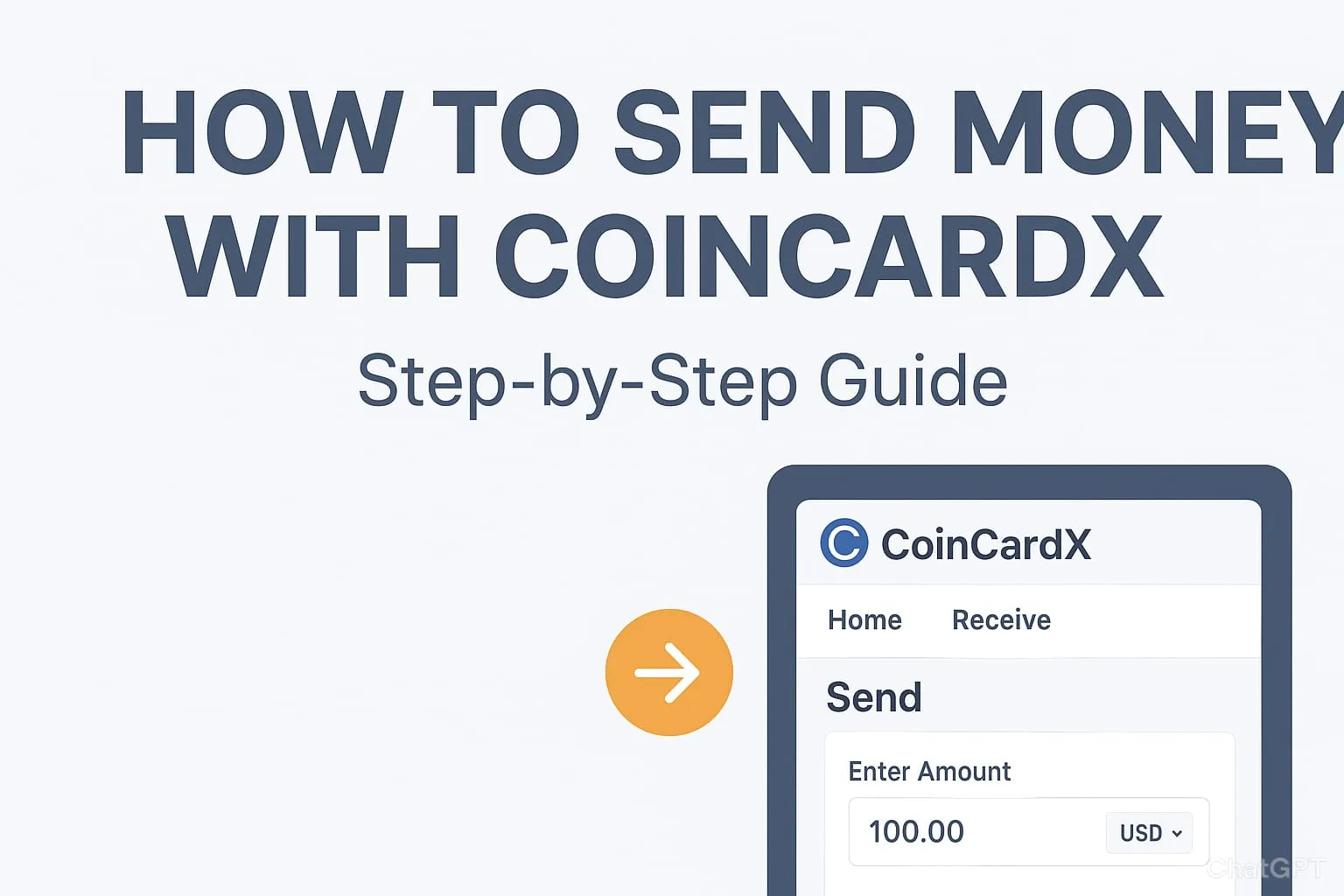

1. CoinCardX

Features: Load with cryptocurrency, secure transactions, and global usability

Best for: Netflix, Amazon, and other online services

2. Privacy.com

Features: Unique card number for each transaction, enhanced privacy

Best for: Subscriptions and digital purchases

3. Neteller Virtual Card

Features: Easy top-up, supports both virtual and physical cards

Best for: International transactions and gaming sites

4. Skrill Virtual Prepaid Card

Features: Instant card generation, low fees, globally accepted

Best for: Online shopping and digital subscriptions

5. Wise Virtual Debit Card

Features: Multi-currency support, low transaction fees

Best for: International purchases and travel expenses

Why Should You Use a Virtual Credit Card?

Better Security – No risk of credit card theft or fraud

Easy Spending Control – Set limits to avoid overspending

Anonymous Transactions – Helps protect privacy

Bypass Geo-Restrictions – Use services in different countries

Conclusion

If you want a safe and convenient way to make online payments, a virtual credit card is the best choice. Choose from the options above and enhance your digital transactions today!